Tax dispute and audit IRS

Seeking assistance from Polus Consulting experts ensures you receive expert tax consultation and support, helping you comply with tax laws and regulations and smoothly navigate an IRS audit without unnecessary stress.

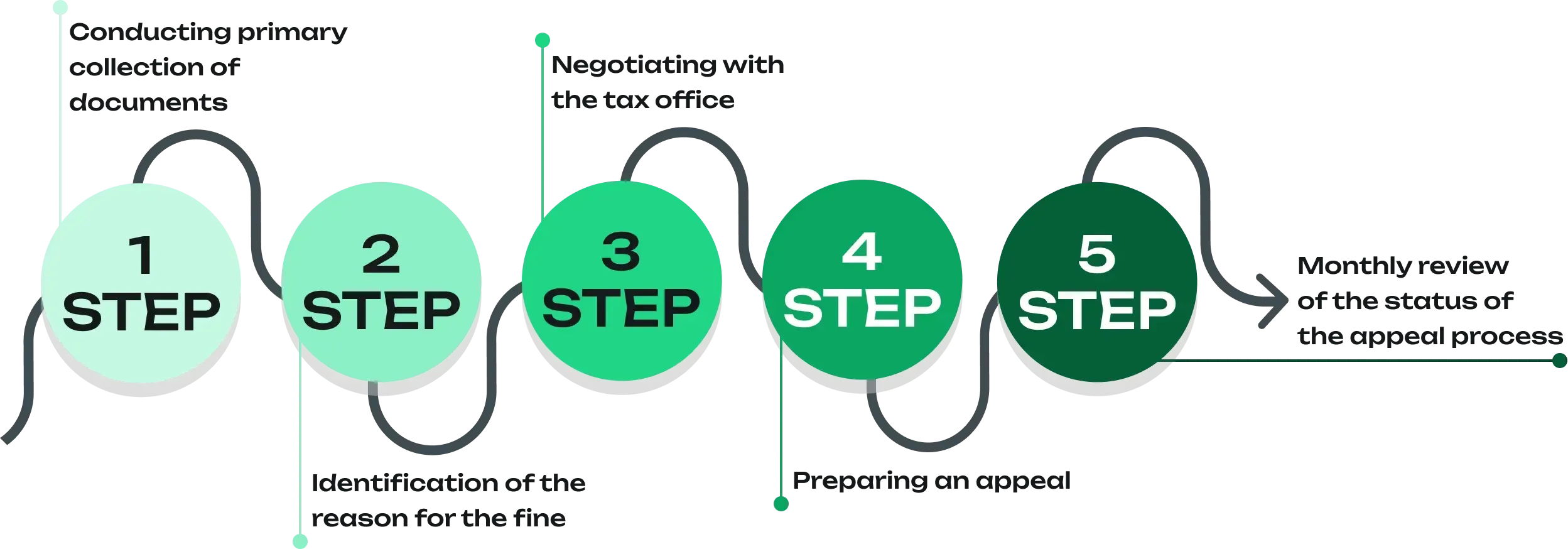

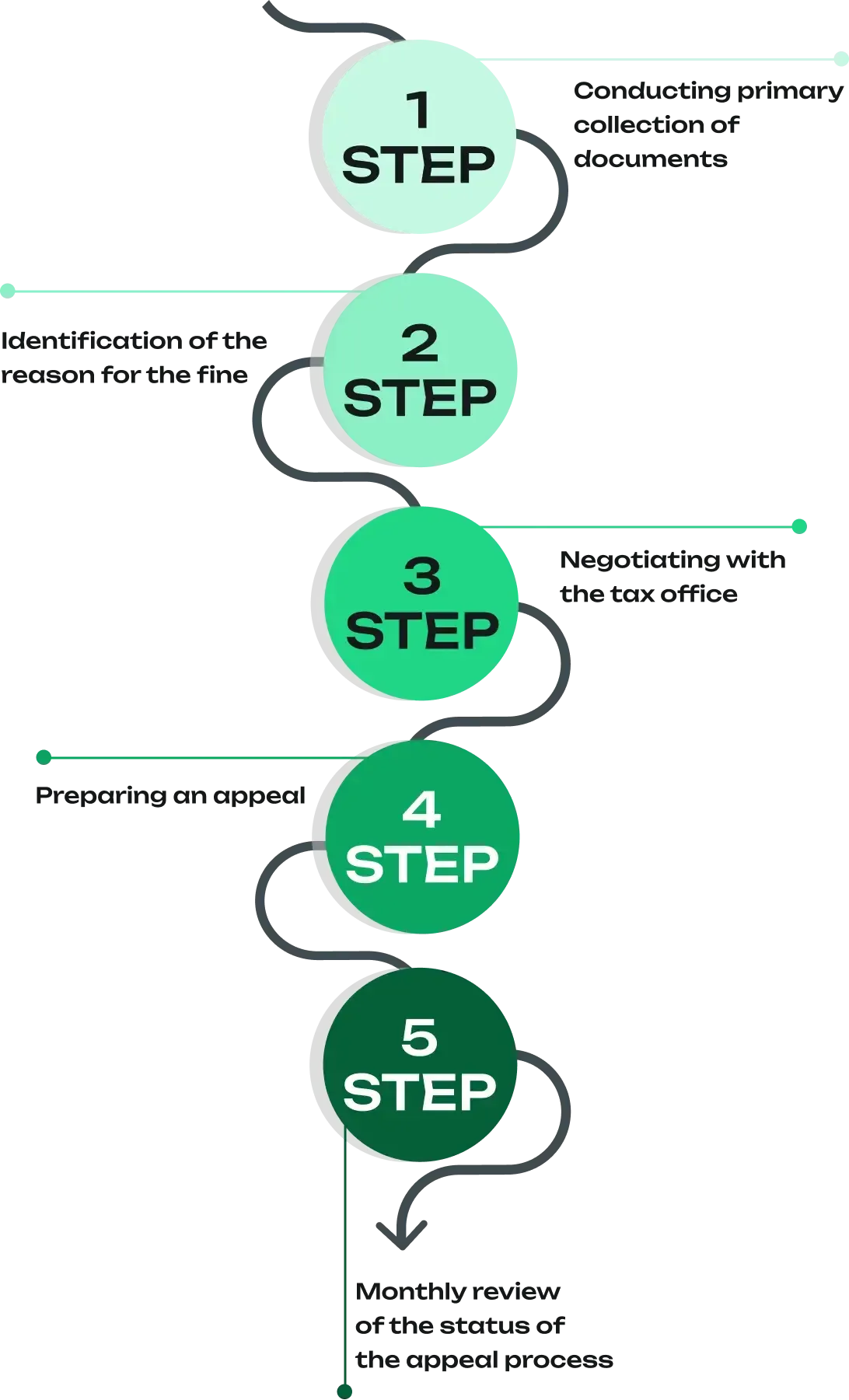

How we can help

Initial collection of current documents

Identifying the reason for IRS requests or penalties

Conducting negotiations with the tax authority

Preparation of necessary documents

Regular monitoring of the company's status with tax authorities

Related services

Challenges of interacting with the IRS without professional support

Complexity of tax legislation

Tax rules and requirements can be confusing and subject to change over time, making it challenging to determine the correct way to complete reporting in accordance with tax laws.

A multitude of tax forms and documents

The tax authorities require filling out various forms and submitting corresponding documentation depending on the situation. This can make it difficult to prepare the necessary materials.

Interacting with auditors

If a tax dispute reaches an IRS audit, providing additional documentation or explanations may be required. In this case, communicating with auditors, presenting data and documents correctly can be challenging.

Document errors

Submitting incorrectly filled tax reports and other documents to the tax authority can lead to additional expenses and other difficulties.

Resolving tax disputes with the IRS

ORDER THE SERVICE

from $5000