Payroll services

Calculating payroll is an essential aspect of running a successful business, regardless of its size. Statistics show many companies face penalties due to incorrect calculations or delays in paying taxes related to their employees' wages.

How we can help

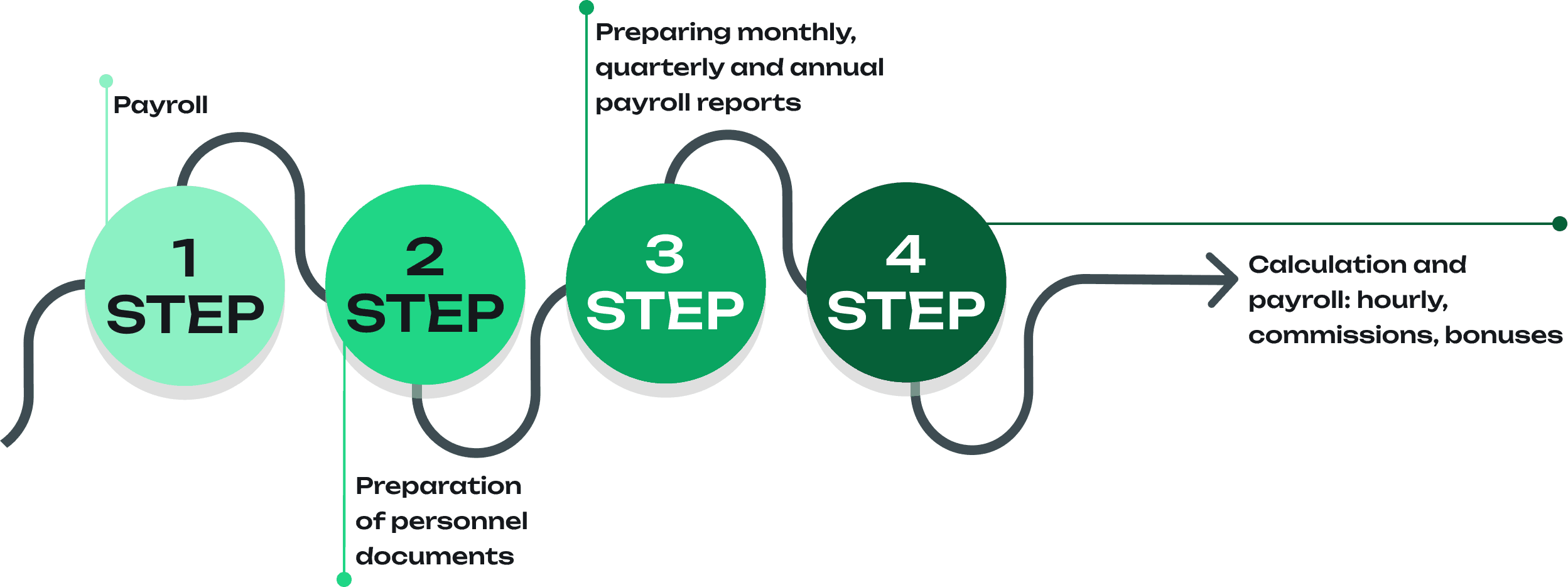

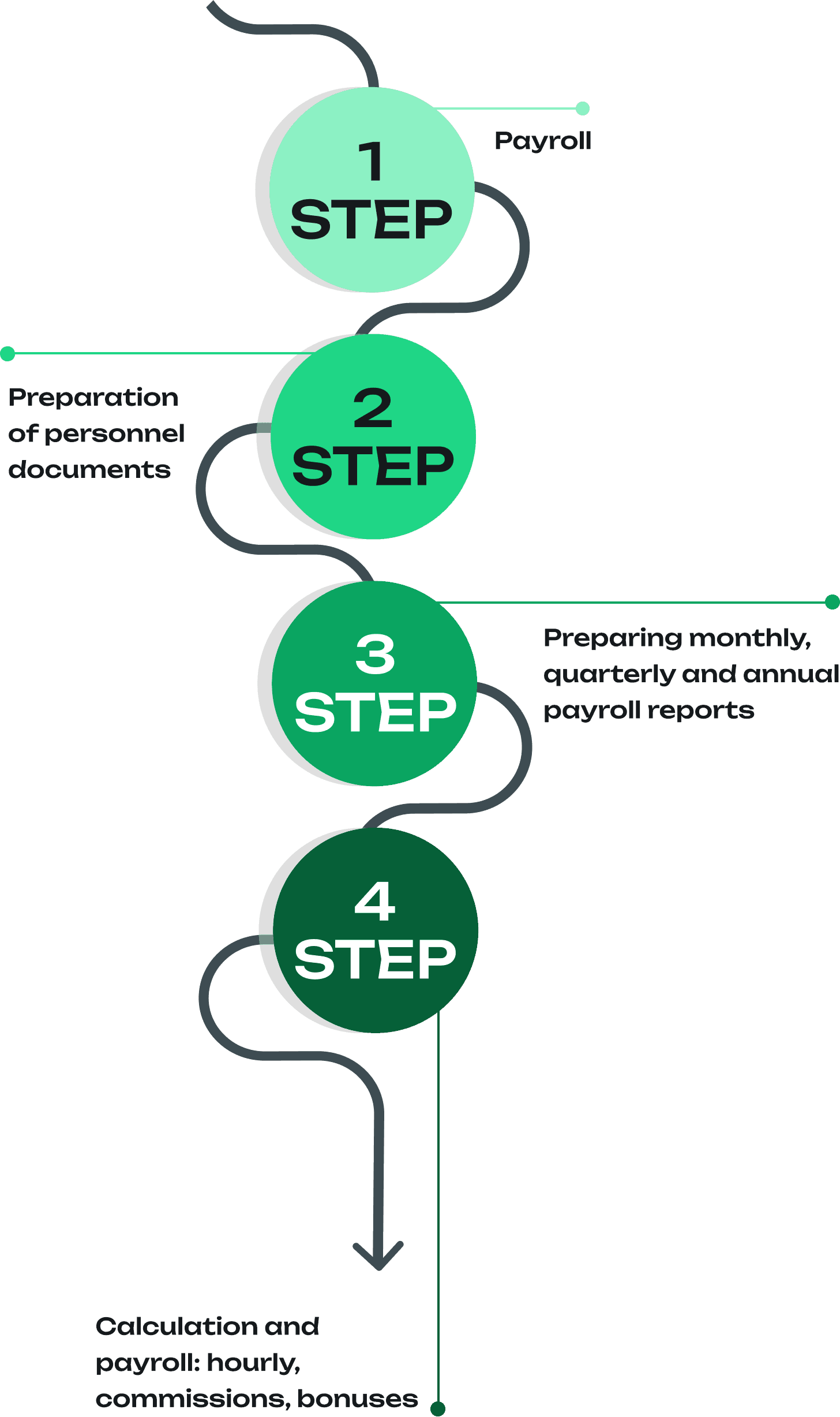

Preparation of documents for employee onboarding

Calculation and processing of payroll and deductions

Preparation of payroll reports

RELATED SERVICES

Challenges in self-calculating and reporting on payroll in the US

Challenges of special categories

It is important to understand the specifics of working with contract employees, certain professional groups, seasonal workers, etc., to avoid errors and penalties in the relevant reports.

Preparation and submission of reports

It is necessary to control competent preparation and timely submission of reports on employee salaries both for internal accounting and to the tax authorities

Deductions from wages provisions

Employers are required to account for necessary deductions from wages, such as taxes, insurance contributions, and other payments.

Compliance with legislative requirements

In the US, there are numerous laws regulating wage issues, including minimum wage rates, overtime pay, paid vacations, and other aspects.

Step-by-step processes for employee payroll

ORDER THE SERVICE

from $150