Tax planning and optimization

The US tax system has several distinctive features that can impact business success in the long run. In particular, it is crucial to choose the optimal accounting method during the initial phase of starting a company. The experts at Polyus Consulting will help optimize your taxes and select the best option!

How we can help

Monitoring current documents and tax filings

Identifying tax obligations and potential risks

Offering proposals to optimize income and expense accounting methods

Providing a plan for maximum consideration of tax benefits and deductions

Optimizing tax payments to minimize the taxable base

Related services

The complexities of independent tax planning

Changes in legislation

Even minor changes can significantly affect tax obligations. Therefore, it is important to monitor any changes on a regular basis.

Multi-level tax system

In the US, there is a federal, state, and local level of taxation. Each level has its own tax rates and rules, which complicates the process of calculation and payment.

International factors

International tax treaties, double taxation and other features must be considered if the taxpayer or company has assets or income outside the US.

A variety of tax forms and reports.

Incorrectly filling out tax forms can lead to tax audits and penalties. It is important to know and adhere to all rules for submitting the appropriate reports.

Taxation features regarding deductions and credits

Numerous tax deductions and credits can significantly reduce the taxable base. It is important to understand which deductions and credits are applicable in the case and how to account for them.

Tax shelters and aggressive tax strategies

Improper use of switches and aggressive tax strategies can lead not only to significant fines, but also to criminal liability.

Taxation of companies

Tax planning for business units at different levels is a complex process. It is important to consider depreciation, inventory, tax incentives for businesses, and many other factors.

Errors and penalties

Mistakes in tax reports lead to penalties and interest for late payments. Shortcomings can trigger an audit, which requires significant time and financial expenses.

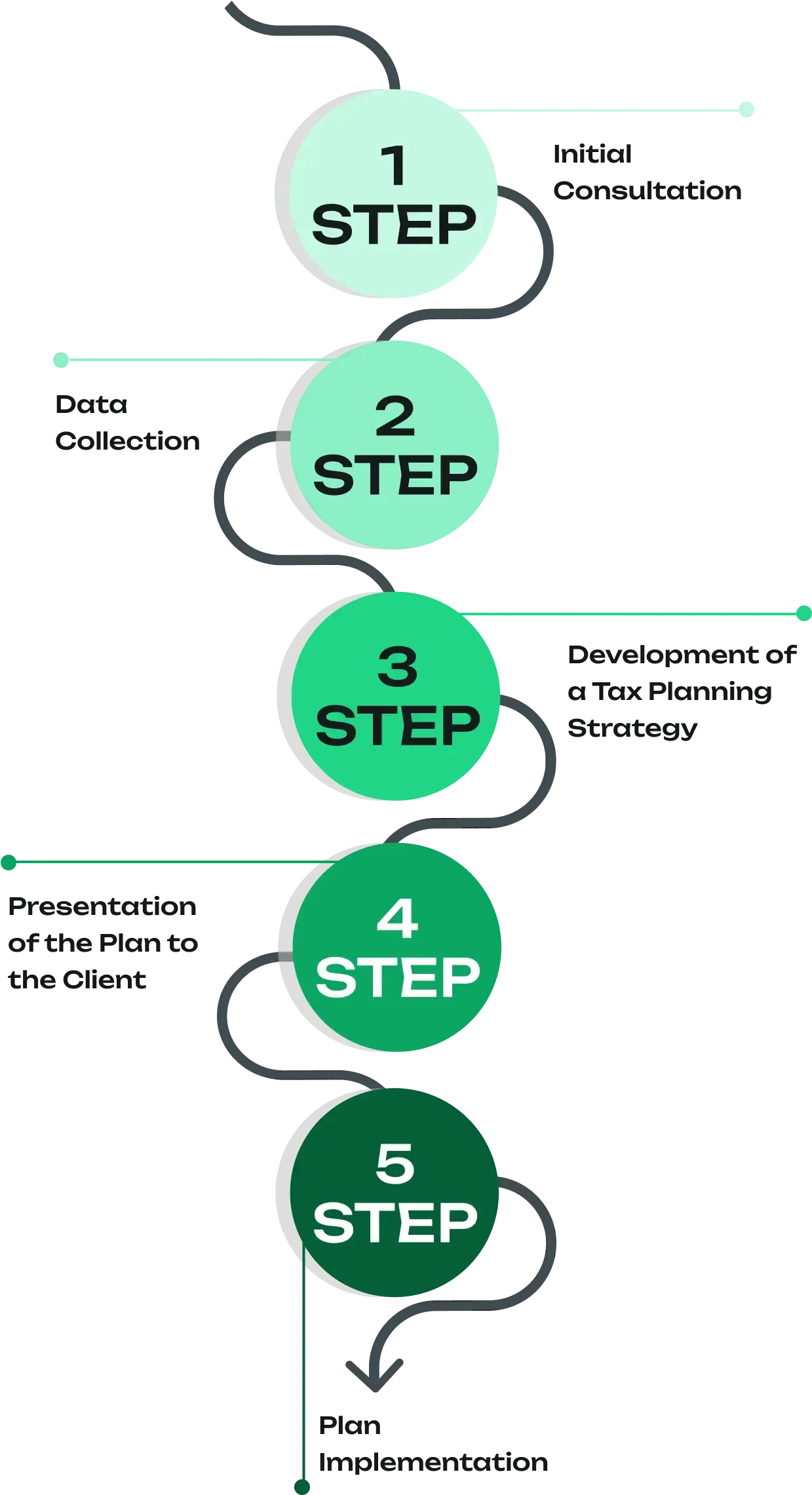

STEP-BY-STEP PROCCESS OF TAX PLANNING

ORDER THE SERVICE

from $700