Tax report preparation

The Polyus Consulting team has deep expertise in taxation and stays abreast of the latest trends in tax legislation. Our experience allows us to minimize the risks of potential errors and inaccuracies that could lead to fines or even scrutiny of the annual report.

How we can help

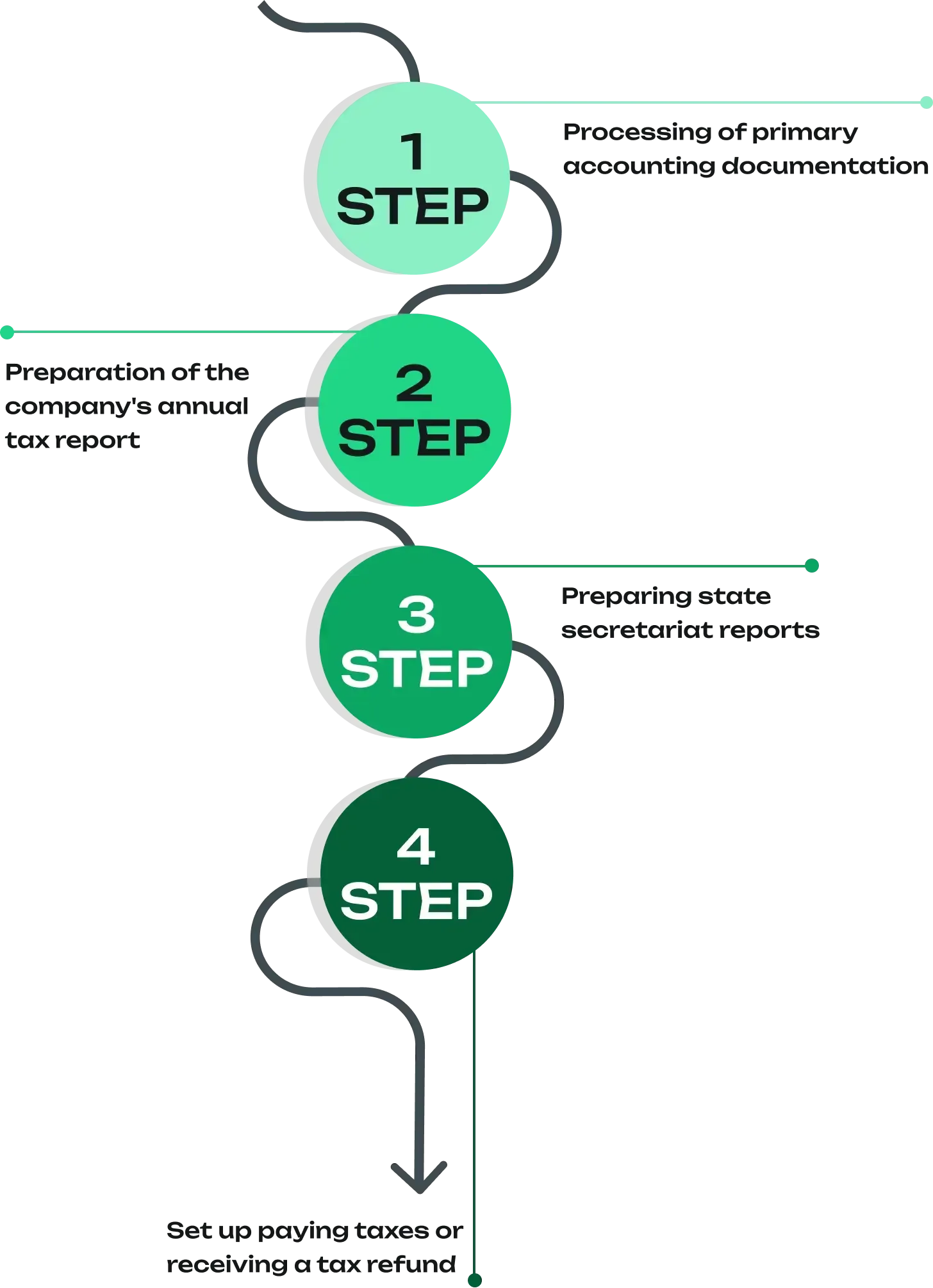

Primary documentation review

Preparation of state secretary reports

Preparation of annual tax return

Tax payment or tax refund retrieval

Related services

Challenges of self-preparing an annual tax report

The challenge of tax optimization

Lack of deep knowledge and practice leads to missing the opportunity to reduce the tax burden and the risk of paying more than necessary. Tax optimization requires careful analysis of financial processes and the application of various strategies, which are not always obvious without competent assistance.

Errors and penalties

Preparing an annual report requires accuracy and attention to detail. Errors or typos can lead to incorrect tax calculations, which can have negative consequences. Submitting a corrected tax report requires a significant amount of time and effort.

Specifics of tax legislation

Tax legislation in the United States is constantly changing. Compiling an annual tax report requires knowledge of all tax rules, exemptions, benefits, and changes, which can be challenging for an inexperienced person.

Strict format rules

The annual report must comply with strict requirements of the tax authorities. Failure to adhere to formatting rules and errors in reporting can lead to penalties or an audit by the IRS (Internal Revenue Service).

ANNUAL TAX REPORTING PROCESS

ORDER THE SERVICE

from $700